iRhythm: Why A Pivot Will Open The Door To A Great Buying Opportunity

Medi(DON'T)care about your heart

This week we’re diving into a MedTech company that may blast off, not like Dogecoin, but close, and whose rationality goes beyond “what will the next person pay” to actual measurable value. Don’t hate me for saying that. YOLO! Let’s take a look at iRhythm...aka iRocket?!

IRTC background

iRhythm Technologies (Nasdaq: IRTC) is a San Francisco digital healthcare company which stemmed from Stanford University’s Biodesign program.1 The company is “redefining the way cardiac arrhythmias are clinically diagnosed by combining wearable biosensor devices worn for up to 14 days. IRTC uses cloud-based data analytics with powerful proprietary algorithms that distill data from millions of heartbeats into clinically actionable information. The company believes improvements in arrhythmia detection and characterization have the potential to change clinical management of patients.”2

Here’s the patch below - it looks like a large bandaid and can be worn while exercising, showering, and other daily activities.

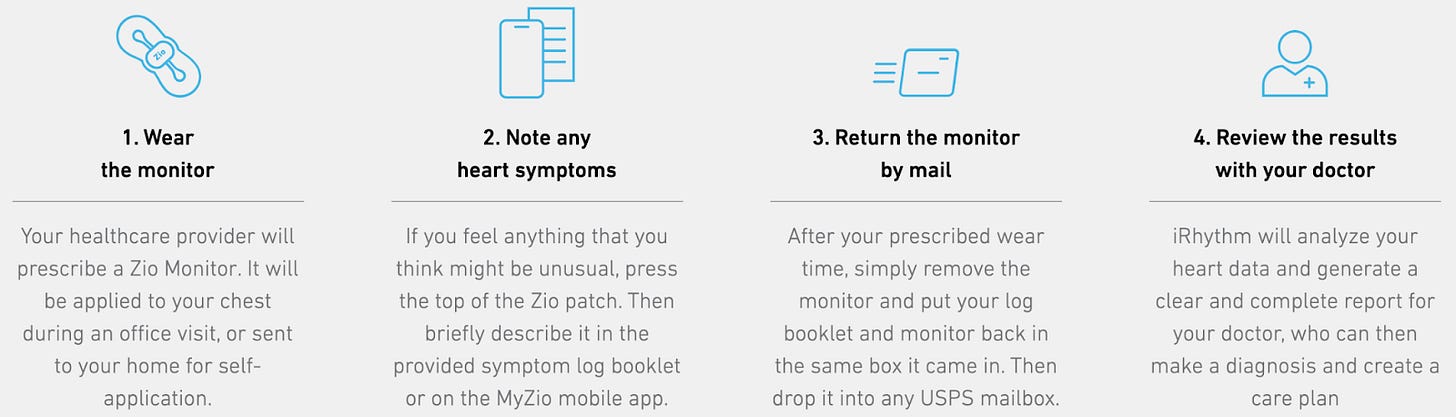

This is their standard model for using the patch as well as getting results/ diagnosis.

How Zio Works

IRTC: Why It’s Sinking Like The Titanic. History - Medicare/Novitas

Back on April 10, 2021, Novitas changed reimbursement rates for Current Procedural Terminology (CPT) codes 93243 and 93247 to $103 and $115, respectively.3 CPT codes are one of the common ways for doctors to bill insurances for services rendered. Novitas is a healthcare insurance program and serves as a Part A/B Medicare Administrative Contractor (MAC) under multiple contracts for the Centers for Medicare and Medicaid Services (CMS).4 These new rates are retroactive to January 1, 2021 and will replace the rates that were published in late January. According to iRhythm, although these new rates are higher than those published on January 29th, “these rates do not appropriately reflect the clinical and economic value that long-term continuous ECG monitoring offers patients, their care teams, or the Medicare system.” Or in other words, IRTC doesn’t like these new rates nor can they run their business with these prices.

We’ll dig into these numbers later, but at these new rates, iRhythm will not be able to provide their Zio XT services to the Medicare fee for service section as the mere operating costs of the company are the same if not higher than the reimbursed rate. Due to these changes, the company may no longer provide Zio XT to this Medicare segment starting in Q2/Q3 2021.

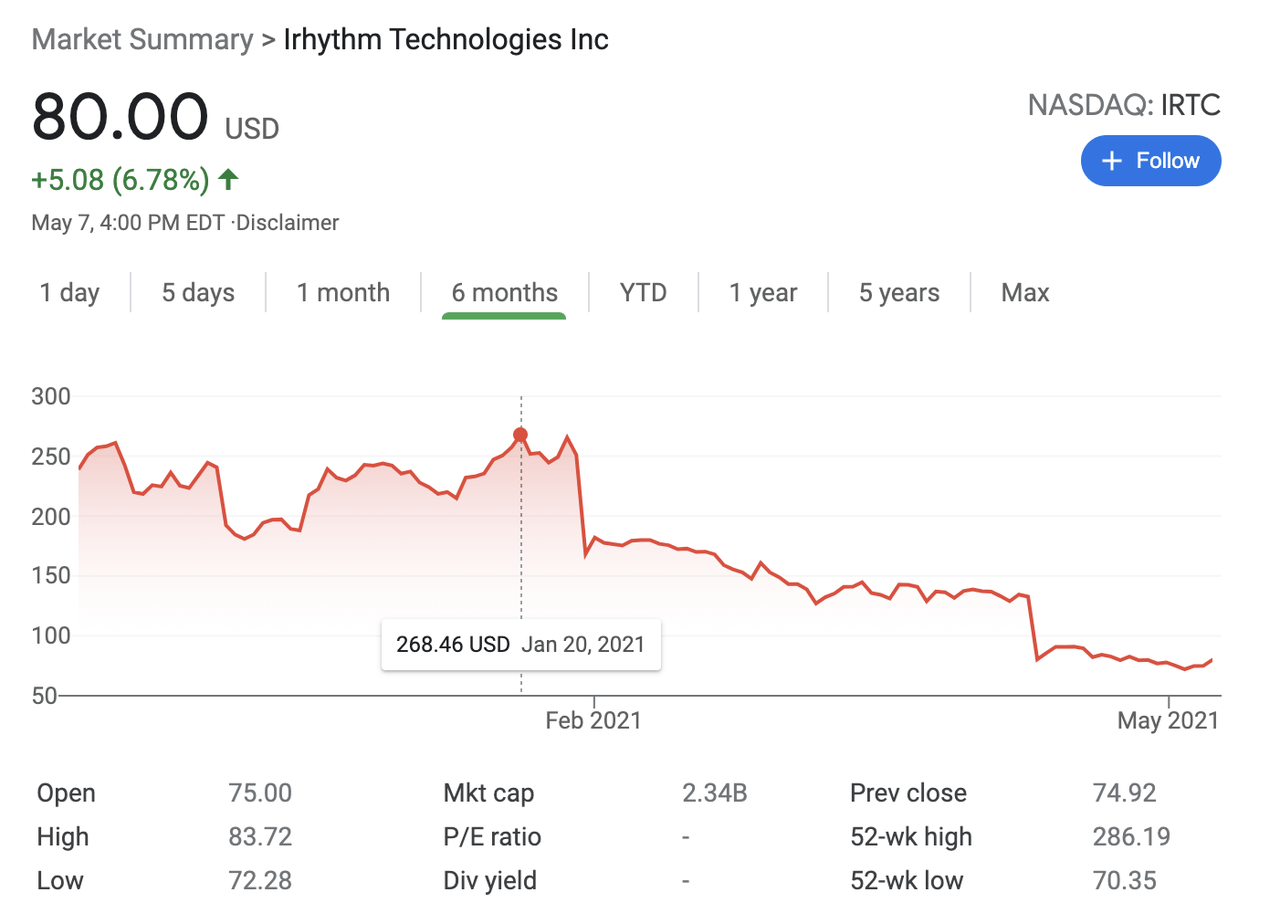

iRhythm’s stock has plummeted from its high of $286.19 to $70.35 (image below per Google Finance) in May 2021. OUCH!

Paths forward for IRTC: Speculation

Before examining what options iRhythm may have let’s review some info. iRhythm by the numbers:

This won’t be exactly precise, but we can make a fair assumption that if Medicare is paying $311, the other insurance groups are also paying something close to $311 (some higher and some lower). However, Medicare is the one who sets the standard and other groups tend to follow.

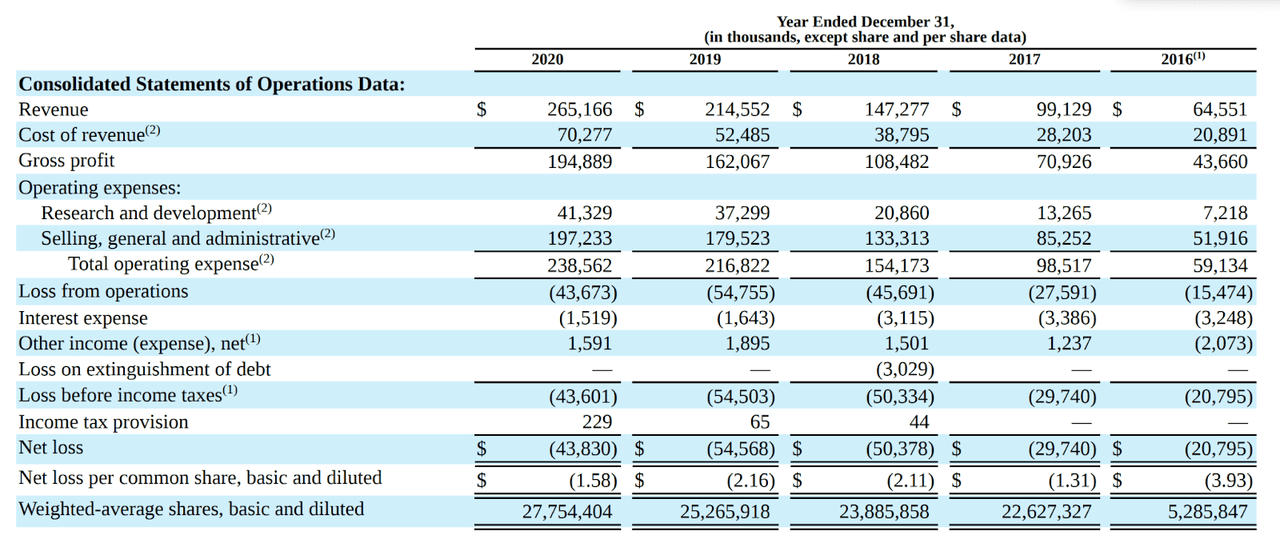

Let’s look at iRhythm’s 10-K to calculate the numbers:

iRhythm’s 10-K: December 31, 2020: IRTC 10-K

Looking at 2020 revenue, we can calculate the number of Zio patches used per year as 852,623 ($265,166,000 / $311 = 852,623 patches)

The cost of revenue per patch is $82.42 ($70,277,000 / 852,623 = $82.42)

R&D: $48.47 ($41,329,000 / 852,623 = $48.47)

SG&A: $231.32 ($197,233,000 / 852,623 = $231.32)

The new 2021 reimbursement by Medicare is $103 to $115. Assuming that you get reimbursed $115 and we take the cost of revenue per patch of $82.42, this yields a gross profit of $32.58 ($115 - $82.42 = $32.58). At the rate of $115, IRTC would have to figure out how to pay for their SG&A and R&D with the remaining $32.58. Given that R&D currently costs $48.47 and SG&A costs $231.32, a gross profit of $32.58 makes running the business very difficult. As Sweet Brown says, “ain’t nobody got time for that.”

We’re going to make a lot of assumptions here, and again, this isn’t exact, but let’s see if we can come up with a bare minimum number for reimbursement. Given iRhythm’s 10-K numbers, the scale of economies just doesn’t seem to exist in their world, at least not yet. They’ll have to continue to put money into R&D and they’ll always need people to run the company and sell products. Again, hypothetically, let’s say they need at least 50% of the R&D and SG&A, what number does this put them at?

$82.42 + ($48.47 / 2)+($231.32 / 2) = $222.32

This means that anything below $222.32 in reimbursement might as well be zero as the company won’t be able to operate in their current form.

Makes you wonder how iRhythm’s competitors managed to survive, and possibly thrive before iRhythm. We’ll have to dig into this further.

Now that we have back of the napkin numbers, we can think through what the options are.

Business model changes - how does the company survive?

How does IRTC survive and potentially become iRocket?

Medicare increases reimbursement to $222.32 or higher. (70%+ this happens, in my opinion (IMO). My reasoning, this isn’t iRhythm’s 1st rodeo with a rate reduction. The same occurred in 2016 and Medicare retracted their reimbursement back to $300+).

a. Novitas is the MAC (one of 12 in the U.S.) that established pricing at $103 to $115. It is totally possible that a new MAC could establish favorable pricing and iRhythm could bill the MAC at this higher price. Alternatively, national Medicare steps in and establishes favorable pricing for everyone.

Business model shift (If option #1 falls through, 90%+ chance that one of these occurs IMO).

a. Previous to iRhythm, what did competitors do?

b. Direct to consumer

c. Monetize the data (10+ years worth)

d. Something else. Verily-Google (Alphabet) to the rescue?

3. Buy out

4. Doesn’t necessarily survive --- liquidation (less than 1% as iRhythm appears to have superior technology, IMO)

5. Sell overseas and negotiate with governments on more favorable terms (this is already happening in the UK)5

Going into more detail on a couple of these:

Option 2A: previous to iRhythm, what did competitors do?

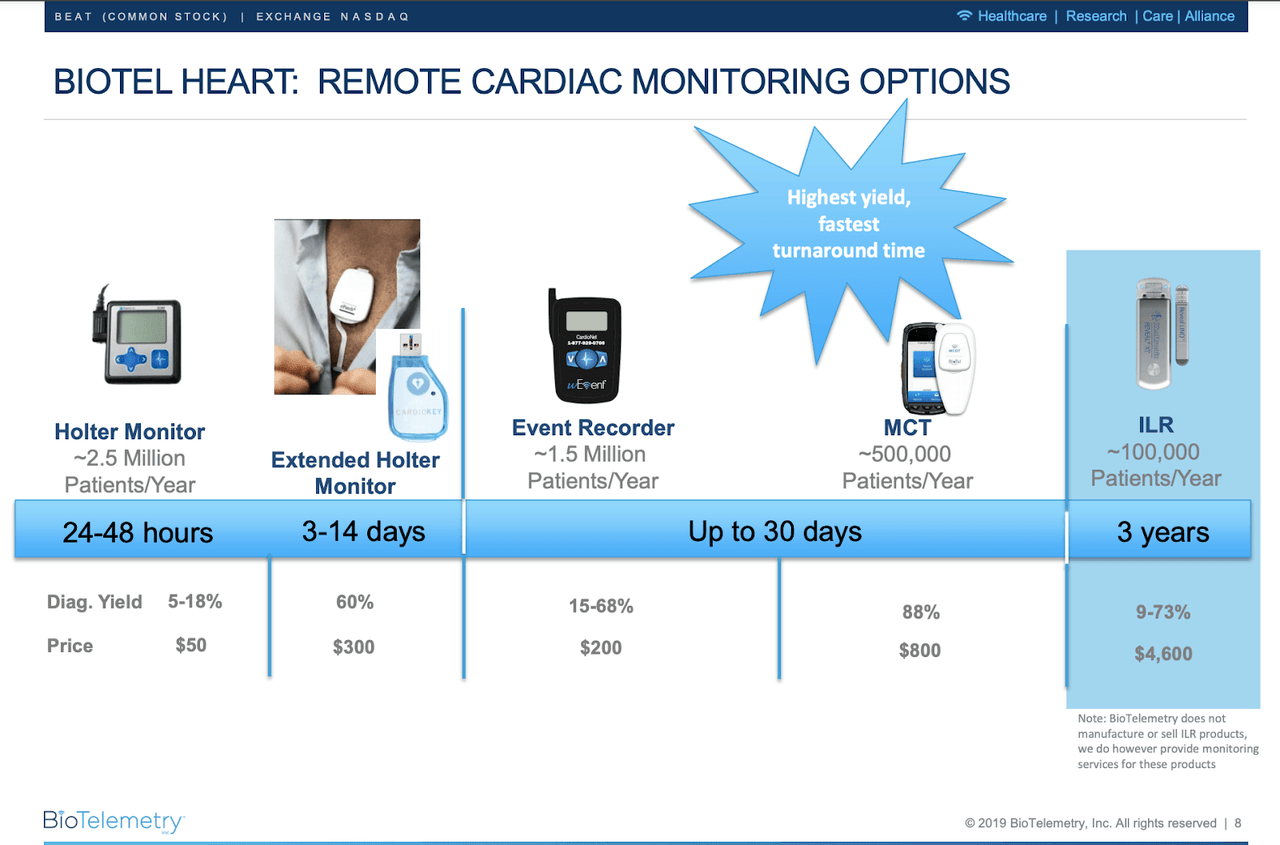

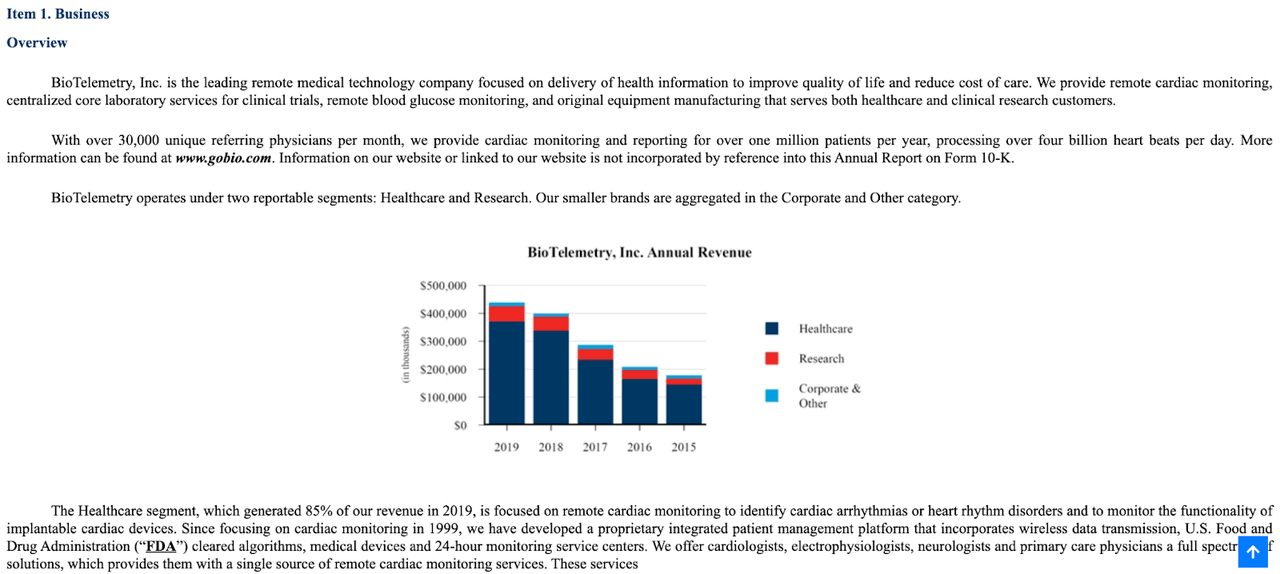

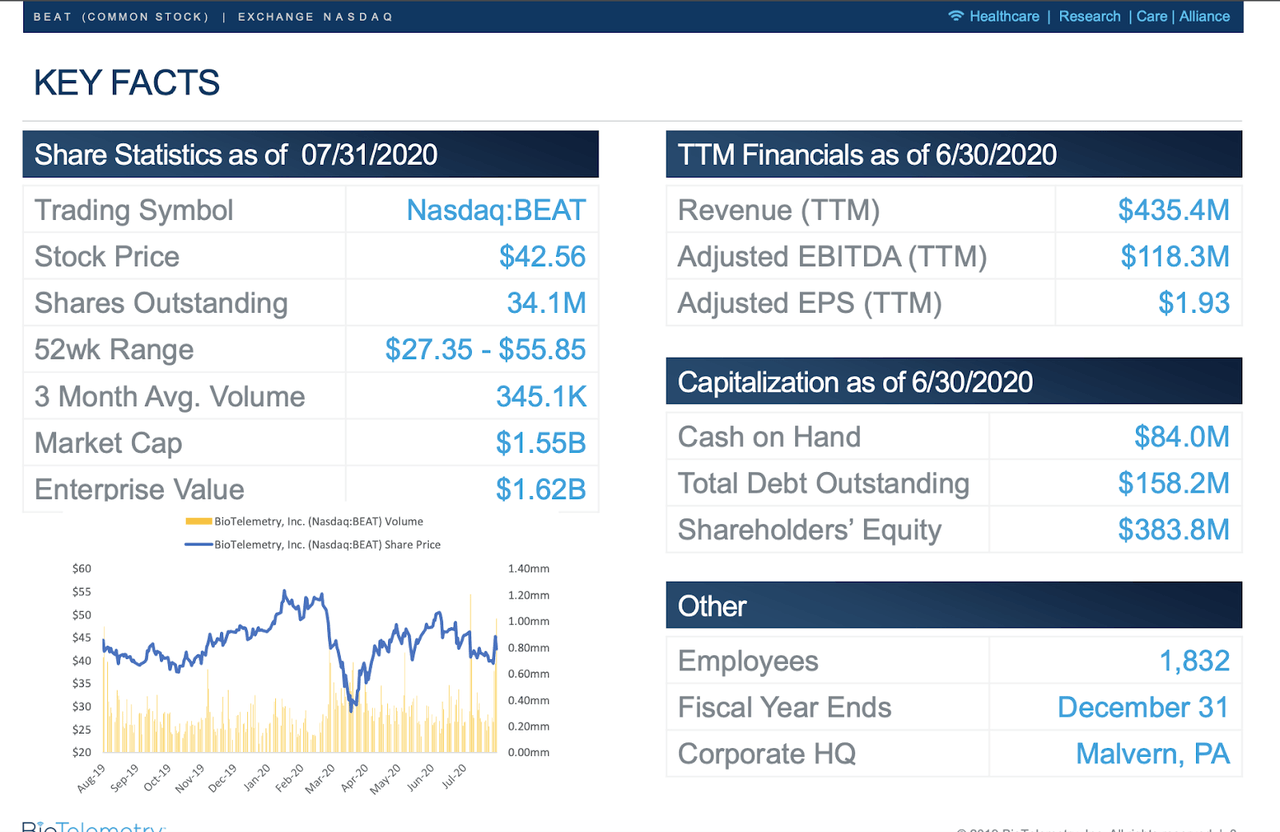

Let’s take a closer look at BioTelemetry, Inc. (Nasdaq: BEAT).

Biotel's Investor Presentation - August 2020

Based on these projections, we can figure out the potential revenues of holters, event recorders, and MCTs for the entire North American Market. For those with a keen eye, Biotelemetry’s presentation decided to “forget” the number of patients/year of the Extended Holter Monitor market a.k.a. Zios. But don’t worry, we know it’s close to 1 million. All Biotel had to do was read IRTC’s 10-K!

*Holters: $50 x 2.5 million units = $125,000,000

*Events: $200 x 1.5 million units = $300,000,000

*MCT: $800 x 0.5 million units = $400,000,000

Given the data above we know two things from the $435.4M TTM Revenue 85%, $370M, came from cardiac monitoring and Biotelemetry treated around 1 M patients. Meaning Biotelemetry is primarily making money from their MCT (Mobile Cardiac Telemetry) product. How do we know this? Quick back of the napkin math, again, say Biotel has 50% of the MCT market and 50% of the Event market:

If we look at the Event Recorder market, we can estimate that Biotel is selling 750,000 million units (1.5 M patients/year x 50% of the market) at $200 each. This would equal $150 M ($200 x 0.750 million units = $150 M)

If we look at the MCT market, we can estimate that Biotel is selling 250,000 million units (500 M patients/year x 50% of the market) at $800 each. This would equal $200 M ($800 x 0.250 million units = $200 M)

This would add up to a Total Revenue of $350M

*Total units = 1 M (from Biotel's investor presentation)

*Pretty darn close to $370M!

What are the Analysts Missing?

Business Model Shift

iRhythm has a not so secret Trojan horse that Wall Street analysts haven’t taken into account in their reports. Not sure why? Are we missing something or are they?

*drumroll*

Introducing Zio AT

Zio AT looks and functions similarly to Zio XT, however, it’s a MCT product! Their clinical data indicates that the Zio AT solution is able to detect critical arrhythmias up to five days sooner than the leading competitor (hmm wonder who that is?). Further analysis indicates that Zio AT achieves a higher diagnostic yield in half the time of leading competitive MCT services (83% diagnostic yield in just 14 days vs. 61% of a competitive service over a 30 day prescription period.)

Zio AT functions just like the Zio XT service which monitors continuously for up to 14 days, delivering a comprehensive report after return and analysis. iRhythm delivers the same comprehensive final report, but also provides physicians with actionable notifications during the wear period. These timely alerts are provided via a Bluetooth capability in the Zio AT monitor that sends data to a wireless gateway. The wireless gateway, slightly larger than a smartphone, is provided to the patient at the time of monitor application and will collect and transmit data from the monitor to the cloud via an LTE protocol. The current Zio AT market is roughly 10% as reported by IRTC’s CEO.

Originally, Zio XT was positioned as the workhorse service while Zio AT was appropriate for the smaller percentage of the population that required timely notification. Yeah, not anymore. This Trojan Horse is about to become the money maker. (*Side note: we realized Medicare has a lot going on but do they not see that they’re about to bite their nose to spite their face? Makes you wonder, or maybe not, why healthcare costs are such a big part of GDP).

Ok, remember these Zio XT numbers from before?

2020 revenue of $265,166,000 / $311 = 852,623 Zio patches

As we see above, the reimbursement for MCT is a nice healthy $800, not $115. Zio AT could realistically replace Zio XT for treating the Medicare population should iRhythm be forced to pivot and survive. Now let’s say iRhythm actually pivoted from Zio XT to AT what would the hypothetical revenue look like? We’ll assume Zio AT replaces 25-30% of Zio XT.

25% of the market:

*$800 x 852,623 x 0.25 = $170,524,600

+ Zio XT revenue

*311 x 852,623 x 0.75 = $198,874,315

= $369 M

30% of the market:

*$800 x 852,623 x 0.30 = $204,629,520

+ Zio XT revenue

*311 x 852,623 x 0.70 = $185,616,027

= $390 M

Total IRTC revenue would land somewhere between $369 M and $390 M.

Side note: As a shareholder, why isn’t iRhythm doing this already? As a tax paying citizen, is Medicare crazy? What sort of strategy is picking up pennies in front of a bulldozer?

This looks a lot better than their reimbursement at $115 and they can survive on this. If you can’t survive on this when the competitors have, there’s obviously a problem.

Assuming iRhythm makes this pivot, not much of a stretch considering this is what iRhythm’s competitors presently do, let’s take a look at possible stock price targets. I say price targets instead of valuation because iRhythm is presently beating to the beat of the price drum not necessarily discounted future cash flows, just an opinion.

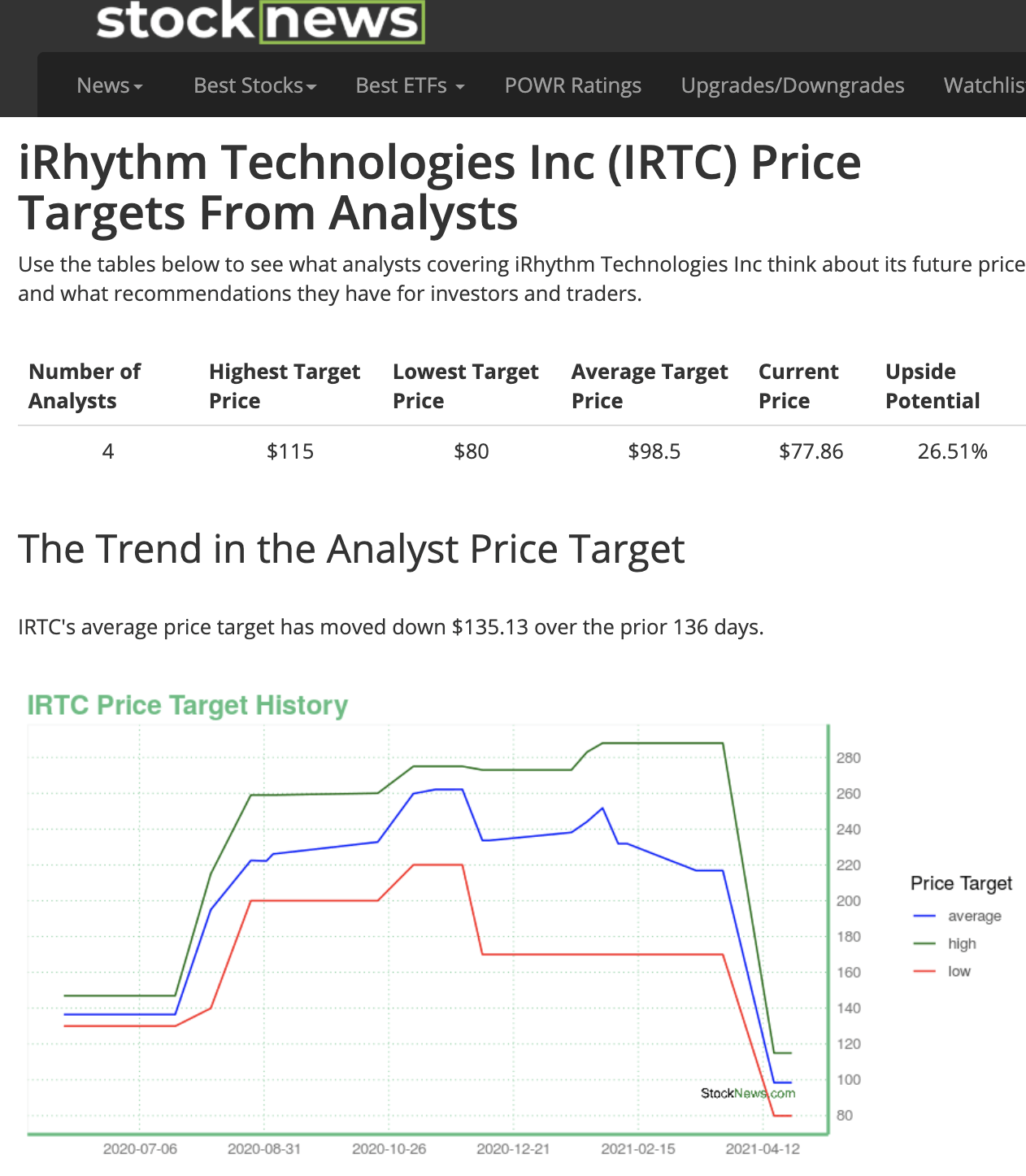

Per StockNews, you can see a meta of various price targets. Before the Medicare announcement iRhythm’s price target range was ~$220 - ~$280, a 3x to 4x from todays prices and Zio usage (unit volume) is still growing at 31% YoY6 and firing on all cylinders per iRhythm’s CEO, Mike Coyle, on the latest IRTC Q1 2021 earnings call.

At these potential revenue range of $369-390, iRhythm is way ahead of their EOY 2020 numbers. This is assuming zero growth in the market. Imagine if the 10-K reported Zio AT with 25% or 30% market share. The price would blow way past the high set on January 2021 of $286.19! Talk about a nice 3-4x from today’s price in the $70s.

Option #2B: Business Model Shift - Direct to Consumer

IRTC takes their technology direct to consumer. I’ll go into more detail later about their collaboration with Verily.

They can also have a subscription model similar to One Medical. Think of this as wearing the device like the Oura Ring or WHOOP, but having someone on the other side who will review the ECG charts if you’re having a cardiac event. OneMedical charges about $200/year for their concierge medicine service.

Option #2C: Business Model Shift - Monetize the Data

iRhythm has 10+ years worth of data that they’ve been collecting but have yet to monetize. According to their 10-K, since receiving clearance from the FDA in 2009, “we have provided the Zio service to over three million patients and have collected over 750 million hours of curated heartbeat data, creating what we believe to be the world’s largest repository of ambulatory ECG patient data. This data provides us with a competitive advantage by informing our proprietary deep-learned algorithms, which may enable operating efficiencies, gross margin improvement and business scalability.”

The company’s moat is their data and they’re sitting on a boatload of it. So, what do they do with all this great information about arrhythmias that’s sitting in the cloud?

Maybe a company like Snowflake could be the catalyst that allows iRhythm to sell their data.

Option #2D: Verily to the rescue?

Verily recently received an FDA 510(k) clearance for its Study Watch, which is a watch with sensor-based device for non-invasive, continuous monitoring. On January 23, 2020, they announced an additional 510(k) clearance for Irregular Pulse Monitor, which is in collaboration with iRhythm. In Verily’s press release, they state that “iRhythm’s own research estimates that 10 million Americans are at high risk for atrial fibrillation (AFib) -- the most prevalent irregular heartbeat that can lead to blood clots and stroke. Our objective is clear: work together to develop best-in-class solutions for improved screening, diagnosis and management of patients with AFib.”7

New 510(k) boosts iRhythm, Verily efforts for AFib screening

iRhythm closed on a $115 M stock offering in September 2019 to support this partnership with Verily.8 Together, they will develop AI-based screening, diagnosis and management technology. Who knows what lies ahead in this collaboration, but I could see more deals ahead or some M&A action.

What can go wrong? What’s the downside?

Without a doubt, there are a bunch of risks that can happen:

The company is stubborn and fails to adapt a new business model -- medium risk: In this case, the management team and board of directors believe that they will survive regardless of the current landscape, and the company goes bankrupt. It’s absolutely possible that the company is too narrow-minded and believing that their technology success will save them. They do have the best product in the space and they have collected an unbelievable amount of data (~10 years worth) which they still haven’t monetized. Maybe the company is drinking the Kool-Aid and underestimating the potential downside. It’s an absolute possibility and this would crush the company.

There is an opportunity for M&A, but the other company wants to wait it out until IRTC is low on cash -- low risk: The management team and board of directors most likely will not sell the company as a fire sale. Their technology is still the best product out there.

IRTC needs to raise capital and can’t get a good deal -- low risk: This would happen in about 1.5-2 years as their runway is good through then. If the company is failing, a shelf offering would send their stock spiraling downwards even further and their current shareholders would be diluted. Fortunately, debt is currently cheap so they could take that option.

Competitors release a product that’s equally as good, if not better -- medium/low risk: I see this as a medium risk for a large tech company such as Google/Verily, Apple, or Amazon. I see this as a low risk for a smaller startup as 1) they are years behind on capturing data, 2) the market penetration would take years to take away from IRTC and holter monitors, 3) the companies that shown me their pitch decks are literally just trying to copy IRTC and their products aren’t better. However, the larger tech companies do build almost everything in stealth mode and it’s possible that the new Apple watch has improved to catch more than 12 arrhythmias (although their wrist capture isn’t nearly as accurate and currently can’t catch enough). Overall, IRTC is still a prescription product and needs to go through a doctor and a tech company would not go through this route.

What’s the recommendation?

With every company there’s always risk. Could the company go down from here? Yes. This would be caused by a management team that decides to go down with the Titanic rather than take advantage of the opportunity they have right here. I’d say this would be an amateur mistake and highly unlikely given the credentials of their new CEO, Mike Coyle (Mike Coyle leaving Medtronic to become CEO of iRhythm). However, I view this as a company that has taken an absolute beating by Wall Street and I doubt that the price will go down much more.

I like the opportunity here and see it as a potential 3-4x, getting back to the $250s just by switching the model to Zio AT. If the company announces this, the stock will jump right back up to where it was in the good ‘ole days.

As always, would love to hear your thoughts on iRhythm and if you hear of any other companies/ideas that are up and coming that you want me to cover.

Cheers,

VentureRamble

https://biodesign.stanford.edu/our-impact/technologies/irhythm.html

Global Newswire

https://investors.irhythmtech.com/news-releases/news-release-details/irhythmr-technologies-provides-statement-medicare-administrative

https://www.cms.gov/Medicare/Medicare-Contracting/Medicare-Administrative-Contractors/What-is-a-MAC

https://investors.irhythmtech.com/news-releases/news-release-details/irhythm-technologies-receives-positive-national-guidance-first

https://investors.irhythmtech.com/news-releases/news-release-details/irhythm-technologies-announces-first-quarter-2021-financial

https://www.irhythmtech.com/company/press-releases/irhythm-announces-collaboration-with-verily-to-develop-health-management-solutions-for-atrial-fibrillation-patients

https://www.massdevice.com/irhythm-closes-115m-offering/